When talking about extensions, Sidechain is a separate blockchain that runs in parallel to a main blockchain (or mainnet) and enables assets to move between them. It lets developers experiment without touching the core protocol, while still letting users transfer value back and forth. In simple terms, think of a sidechain as a sandbox that shares the same playground as the main chain but has its own set of rules.

To understand why sidechains matter, we first need a quick refresher on Blockchain is a distributed ledger where transactions are grouped into blocks and secured by cryptographic consensus. Blockchains like Bitcoin and Ethereum guarantee immutability, but that guarantee comes at a cost: every transaction must be processed by every node, which limits throughput and drives fees up.

Why Do We Need Sidechains?

- Scalability: Mainnets often cap at 7‑15 transactions per second (TPS) for Bitcoin and ~30 TPS for Ethereum (pre‑layer‑2). Sidechains can run their own consensus, allowing thousands of TPS without congesting the main network.

- Experimentation: Developers can trial new governance models, fee structures, or token standards without risking the stability of the primary chain.

- Interoperability: Assets can hop between chains, opening doors for cross‑chain DeFi, gaming, and supply‑chain applications.

- Security Flexibility: A sidechain can adopt a different consensus (e.g., Proof of Stake) while the mainnet stays Proof of Work, letting users choose the risk‑reward profile they prefer.

How Sidechains Connect to the Mainnet

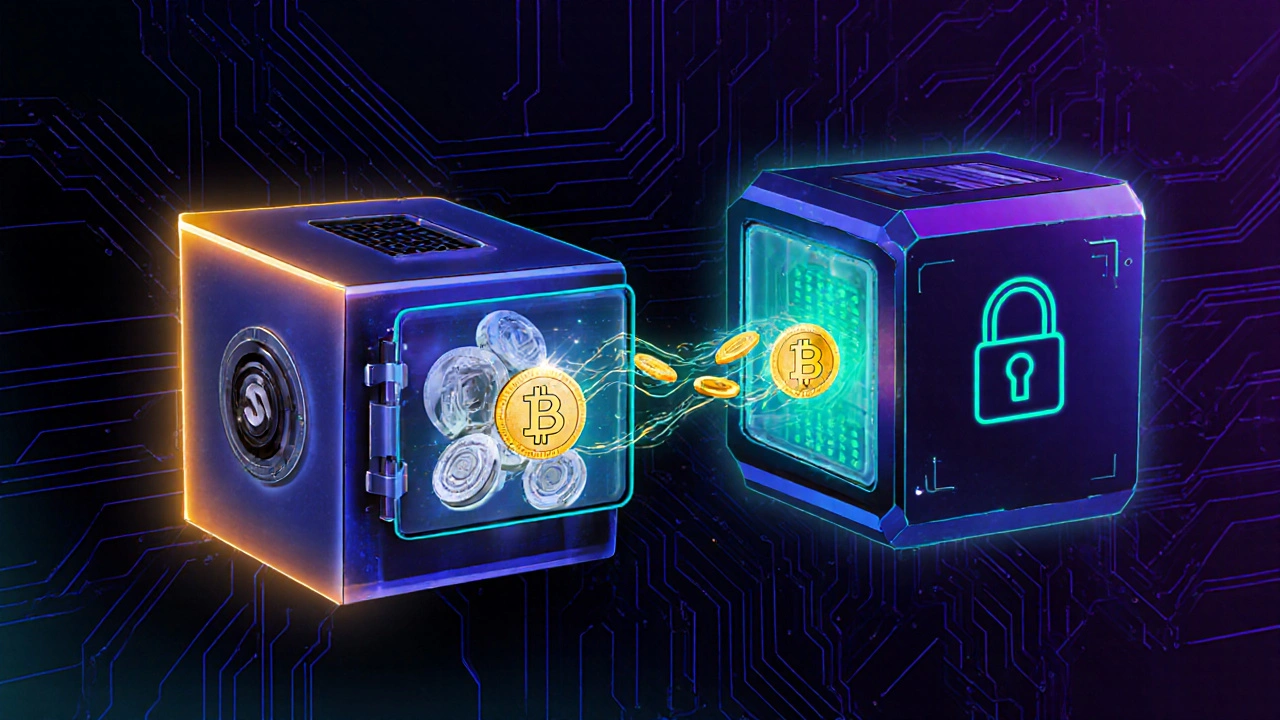

The bridge between a sidechain and its parent blockchain is usually a smart contract or a set of custodial nodes that lock assets on the mainnet and mint equivalents on the sidechain. This process has three stages:

- Lock: Users send tokens to a bridge contract on the mainnet. The contract locks the assets, preventing them from being spent.

- Mint/Release: Once the lock is confirmed, the bridge instructs the sidechain to mint a matching amount of wrapped tokens (e.g., wBTC on Ethereum) or release existing ones.

- Redeem: When users want to move back, they burn the wrapped tokens on the sidechain, and the bridge unlocks the original assets on the mainnet.

This two‑way peg maintains total supply and ensures that the sidechain version is always fully backed by the original asset.

Consensus Mechanisms on Sidechains

Sidechains are free to pick any consensus they like. Some popular choices include:

- Proof of Stake (PoS): Validators stake tokens to propose blocks. Ethereum’s own Beacon Chain is a PoS example that can function as a sidechain for L2 solutions.

- Federated Consensus: A known set of validators (e.g., a consortium of exchanges) take turns signing blocks. This model powers many private‑enterprise sidechains.

- Hybrid Models: Combining PoW for security with PoS for speed, as seen in some experimental networks.

Because consensus is independent, sidechains can achieve lower finality times-often under a second-compared to the several‑minute finality of Bitcoin’s PoW.

Sidechains vs. Other Layer‑2 Solutions

Sidechains are often grouped under the “layer‑2” umbrella, but they differ from state channels, rollups, and the Lightning Network. The table below highlights the most relevant contrasts.

| Feature | Sidechains | State Channels (e.g., Lightning) | Rollups (Optimistic/ZK) |

|---|---|---|---|

| Security Model | Independent consensus; security depends on its validator set | Secured by the underlying mainnet; no separate validators | Security inherited from mainnet; fraud proofs ensure honesty |

| Supported Transactions | Any transaction type, including smart contracts | Simple payments or limited scripts | Any transaction, but data is compressed into a single proof |

| Finality Speed | Milliseconds to seconds, depending on consensus | Near‑instant once channel is open | Seconds for ZK rollups, minutes‑hours for optimistic rollups |

| Complexity of Bridge | Requires custodial or smart‑contract bridge | No bridge needed after channel establishment | Bridge similar to sidechains but often automated via contracts |

| Use Cases | Gaming, high‑frequency DeFi, private consortiums | Micro‑payments, instant remittances | Scalable DApps, NFT marketplaces |

Real‑World Implementations

Several projects have already put sidechains into production:

- Polygon (formerly Matic): Runs a PoS sidechain for Ethereum, delivering >65 K TPS in test environments and enabling cheap transactions for DeFi apps.

- Liquid Network: A Bitcoin sidechain focused on faster settlement and confidential transactions, widely used by exchanges for bulk transfers.

- Rootstock (RSK): Adds smart‑contract capabilities to Bitcoin via a PoS sidechain, allowing Ethereum‑like DApps on the Bitcoin ecosystem.

- Arbitrum Nitro: Though classified as an Optimistic Rollup, it shares many sidechain traits such as its own sequencer and custom VM.

Each of these solutions uses a bridge that locks assets on the mainnet and issues wrapped tokens on the sidechain. The bridge’s security model is critical-if the bridge is compromised, attackers can mint unlimited tokens.

Risks and Pitfalls

Sidechains bring benefits, but they also introduce new attack vectors:

- Bridge Vulnerabilities: The most common failure point. History shows hacks like the Ronin bridge breach (2022) where $600 M was stolen.

- Validator Centralization: Some sidechains rely on a small validator set, making them susceptible to collusion or censorship.

- Incompatible Upgrades: If the mainnet undergoes a hard fork, the sidechain must adapt; failure to do so can cause a split.

- Liquidity Fragmentation: Assets locked on a sidechain are not usable on the mainnet, potentially reducing overall market depth.

Mitigation strategies include regular audits of bridge contracts, using multi‑sig custodians, and designing transparent validator elections.

Designing Your Own Sidechain: A Quick Checklist

- Define Purpose: Is the goal higher throughput, privacy, or custom token economics?

- Select Consensus: PoS for speed, federated for control, or hybrid for a balance.

- Plan the Bridge: Smart‑contract based (trustless) vs. custodial (simpler but riskier).

- Set Security Parameters: Number of validators, slashing conditions, and governance model.

- Test Interoperability: Ensure assets can move both ways without loss or double‑spend.

- Audit and Deploy: Conduct third‑party security audits before live launch.

Following this checklist helps avoid common pitfalls and speeds up time‑to‑market for new blockchain projects.

Future Outlook: Sidechains in 2025 and Beyond

By 2025, sidechains are expected to proliferate alongside rollups and sharding solutions. Key trends include:

- Cross‑Chain Bridges: Unified standards (like IBC for Cosmos) will let sidechains talk to each other, not just the mainnet.

- Zero‑Knowledge Proofs: Sidechains may embed zk‑SNARK verification to prove state transitions without revealing data.

- Regulatory Sandboxes: Governments are experimenting with sidechain‑based pilots for digital asset settlement, offering a controlled environment for compliance.

- Enterprise Adoption: Companies seeking private, high‑speed ledgers are turning to permissioned sidechains tied to public mainnets for auditability.

These developments suggest that sidechains will become a core piece of the multi‑layered blockchain architecture, offering the best of both worlds: scalability without sacrificing the security guarantees of the underlying mainnet.

Frequently Asked Questions

What is the main difference between a sidechain and a rollup?

A sidechain runs its own consensus and can have completely different rules, while a rollup inherits security from the mainnet and posts bundled transaction data back to it.

Can I move any token to a sidechain?

Only tokens that the sidechain’s bridge supports can be transferred. Most bridges start with major assets like Bitcoin, Ether, and stablecoins.

Are sidechains secure?

Security depends on the validator set and the bridge implementation. Trustless bridges and decentralized validator schemes boost security, but they’re not as battle‑tested as a mainnet’s PoW.

How fast are transactions on a sidechain?

Many sidechains achieve sub‑second finality, especially those using PoS or federated consensus. Exact speeds vary by network load and block time settings.

Do sidechains increase transaction fees on the mainnet?

No. Fees incurred on the sidechain are separate. However, locking and unlocking assets on the mainnet still require a standard transaction fee.

Understanding how sidechains operate opens up a world of possibilities for developers, enterprises, and everyday users looking for faster, cheaper blockchain interactions. Whether you’re building a gaming platform, a DeFi protocol, or an enterprise ledger, sidechains give you the flexibility to innovate without sacrificing the safety of the main network.

Sarah Meadows

From a sovereign crypto perspective, sidechains represent a strategic augmentation of national blockchain infrastructure, enabling modular scaling without compromising the core protocol's integrity. By deploying jurisdiction‑aligned consensus mechanisms, we can isolate experimental tokenomics while preserving the sanctity of the primary ledger. This modularity is a manifestation of digital sovereignty, allowing us to iterate at blockchain‑level velocity without exposing the mainnet to volatile code deployments. The parallel execution environment essentially acts as a sandbox with its own security parameters, thereby mitigating systemic risk to the national digital asset ecosystem. Moreover, the ability to tailor validator sets on sidechains reinforces geopolitical resilience by reducing reliance on foreign mining pools. In short, sidechains are the next frontier for any nation seeking blockchain supremacy.

Nathan Pena

While the preceding exposition rightly emphasizes strategic benefits, it neglects a rigorous cost‑benefit analysis. The opportunity cost of allocating capital to a sidechain validator set, especially under a Proof‑of‑Stake paradigm, can be quantified in terms of foregone staking yields on the mainnet. Additionally, the bridge architecture introduces an attack surface whose attack‑vector taxonomy warrants thorough enumeration. Empirically, bridge exploits such as the Ronin incident illustrate a non‑trivial failure probability that scales with contract complexity. Hence, any sovereign implementation must incorporate formal verification of bridge contracts, alongside an economic model that internalizes slashing penalties proportionate to the locked asset value. Only then can the purported scalability gains be reconciled with systemic risk considerations.

Mike Marciniak

The mainstream narrative conveniently glosses over the fact that every bridge is a potential backdoor for the shadow consortium that controls the underlying cryptographic primitives. Those who design the lock‑mint‑redeem cycle are not neutral technologists; they are beholden to powerful entities that profit from obscuring transaction provenance. Historical patterns reveal that bridge contracts are often updated under the guise of "performance improvements" while quietly inserting hidden admin keys. This is not speculation but an observable trend when cross‑referencing code commits with known exploit timelines. Users should remain skeptical of any architecture that requires trust in a custodial bridge, as it fundamentally contradicts the trustless ethos purported by the blockchain community.

VIRENDER KAUL

Let us be clear sidechains are not a panacea they are a trade‑off in security design they shift trust to a smaller validator set and often lack the decentralisation guarantees of the mainnet moreover the bridge component introduces a single point of failure that most projects underestimate it is imperative to conduct rigorous stress testing and formal verification before deployment otherwise the ecosystem suffers from avoidable vulnerabilities

Mbuyiselwa Cindi

Great points raised above, and to add some practical guidance, here's a comprehensive checklist for anyone looking to launch a sidechain safely.

1. **Purpose Definition** – Clearly articulate whether the sidechain aims for higher throughput, privacy, or custom token economics. This determines the consensus and validator design.

2. **Consensus Selection** – Choose between Proof‑of‑Stake for speed, federated consensus for controlled environments, or a hybrid model if you need both security and performance.

3. **Bridge Architecture** – Decide if you will use a trustless smart‑contract bridge (which requires formal verification) or a custodial bridge (simpler but introduces centralisation risk). In either case, enforce multi‑sig control and time‑locked withdrawals.

4. **Validator Set Design** – Aim for a sufficiently large and diverse validator set to avoid centralisation. Implement slashing mechanisms that are proportional to the amount staked to deter malicious behaviour.

5. **Security Audits** – Engage reputable third‑party auditors for both the bridge contracts and the consensus client. Multiple audit rounds are advisable, especially after any major upgrade.

6. **Upgrade Path** – Establish a clear governance process for protocol upgrades, ensuring compatibility with the mainnet to prevent chain splits.

7. **Liquidity Management** – Provide incentives for liquidity providers on both the sidechain and the mainnet to minimize fragmentation. Consider reward programs that are lock‑up period based.

8. **Testing Regimen** – Deploy the sidechain on a testnet first, simulate high‑load scenarios, and perform cross‑chain transaction tests to validate the lock‑mint‑redeem flow end‑to‑end.

9. **Monitoring & Incident Response** – Set up real‑time monitoring for bridge activity and validator performance. Have a documented incident response plan that includes community communication channels.

10. **Regulatory Considerations** – Even though sidechains are technically decentralized, they may fall under specific jurisdictional regulations. Conduct a legal review early in the development cycle.

By methodically addressing each of these items, you dramatically reduce the risk of a bridge hack or validator collusion, and you position your sidechain for sustainable growth within the broader blockchain ecosystem.

Krzysztof Lasocki

Oh great, another sidechain – because the mainnet clearly needed more complexity.

Henry Kelley

i get ur point but lets not forget u cant just stack all the buzzwords and call it a day its alwayz good to test in small steps before going full throttle

Victoria Kingsbury

Sidechains are basically a modular extension layer – think of them as APIs for blockchain scalability. When you isolate consensus, you can tweak block times, gas limits, and even VM execution environments without pulling the whole network offline. This modularity is especially useful for dApps that need sub‑second finality, like gaming or high‑frequency trading, where the base chain’s latency would be a bottleneck.

Tonya Trottman

Honestly, the whole sidechain hype is just a rebranding of old‑school siloed ledgers. If you’re looking for true security, you should focus on roll‑ups that inherit the mainnet’s provable consensus. Sidechains, in contrast, rely on the quaint notion that a smaller validator set can magically replicate Bitcoin’s robustness – a notion that, frankly, belongs in a philosophy textbook, not in a technical whitepaper.